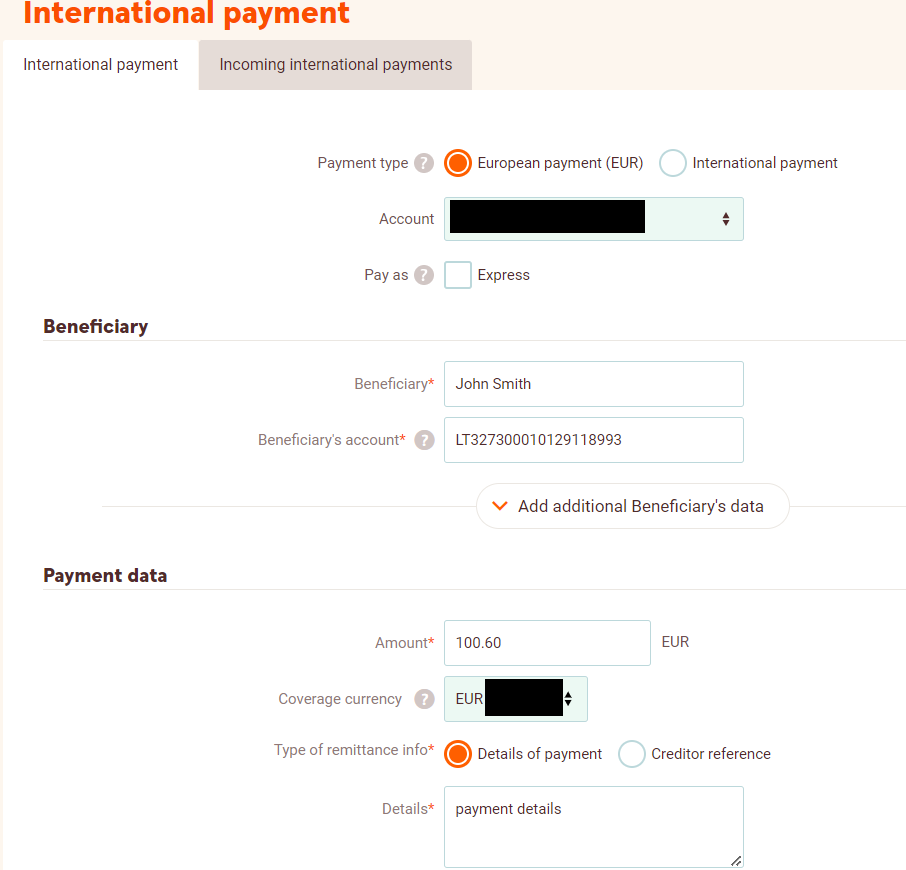

Payment Initiation Fields

This section describes the most common details used to initiate payments (for example, from an Internet Bank).

Mandatory fields for the most common payments (SEPA, Instant, Internal) are:

- Receiver name

- Receiver account number

- Payment details

- Payment amount

In addition, there are several optional fields. Both mandatory and optional fields are described below.

1. BIC (Bank Identification Code)

Payments can be:

- Between accounts inside the same bank

- Between accounts at different banks

The BIC identifies the bank where the payment needs to be sent.

It has two forms: BIC8 (8 characters) and BIC11 (11 characters).

Example: HABALV22XXX (BIC11 for Swedbank Latvia)

Breakdown:

HABA→ Bank code (used by the bank to identify itself)LV→ Country code (shows the country of the bank)22→ Location code (shows where the head office is)XXX→ Branch code (XXX= head branch; if only one branch exists,XXXis always used)

If a bank has only one branch, BIC8 can be used.

Example: HABALV22 (implying the BIC11 is HABALV22XXX).

2. Account Number

Depending on the bank or payment type, account numbers can be in two formats:

-

BBAN (Basic Bank Account Number)

- Mostly used for SWIFT payments

- The BIC must usually be entered manually

- Example:

3463456444(format varies by bank)

-

IBAN (International Bank Account Number)

- Used for SEPA, Instant, and Internal payments

- Entering an IBAN usually auto-fills the BIC

- Example:

LV73HABA001951A196122

IBAN structure (LV example):

LV→ ISO country code73→ Check digits (used to validate account number integrity)HABA→ Bank code001951A196122→ Account number

3. Beneficiary / Receiver / Creditor Name

This is the receiver name of the payment:

- Private example:

John Smith - Corporate example:

Apple Inc.

4. Originator / Sender / Debtor Name

Refers to the sender name of the payment.

Usually auto-filled in payment forms or hidden from the customer.

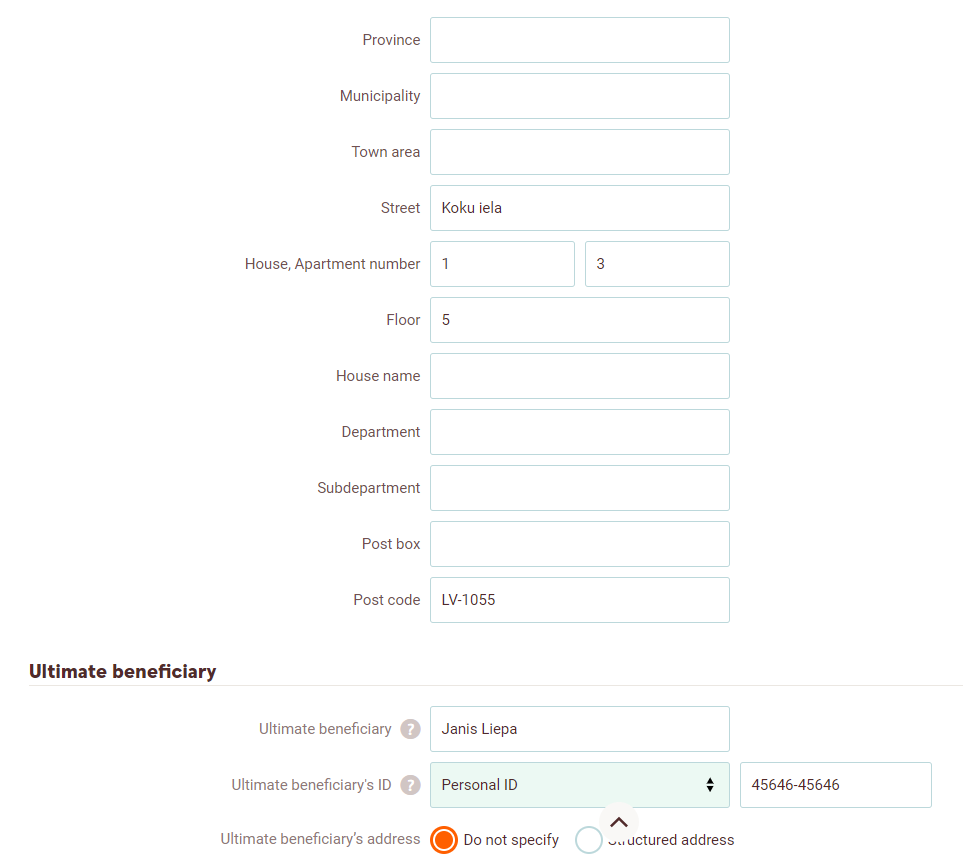

5. Receiver Address

Depending on the bank, this can be unstructured or structured:

-

Unstructured address

- Free text (e.g., up to 70 characters per line)

- Up to two address lines

- Example:

Koku iela 1-3, Rīga, Latvia

-

Structured address

- Entered in separate fields

- Example:

- Street name:

Koku iela - Building number:

1 - Room:

3 - Town name:

Rīga - Country:

Latvia

- Street name:

6. Sender Address

Usually auto-filled. Follows the same rules as the receiver address.

7. Payment Details (Remittance Information)

Describes the purpose of the payment. Two formats:

-

Unstructured: Free text, up to 140 characters

- Example:

"Payment for delivery service"

- Example:

-

Structured: Shorter, often required for bills or invoices

- Example:

"Bill number: 123456" - Must follow specific formats in some countries; otherwise, payments may be rejected.

- Example:

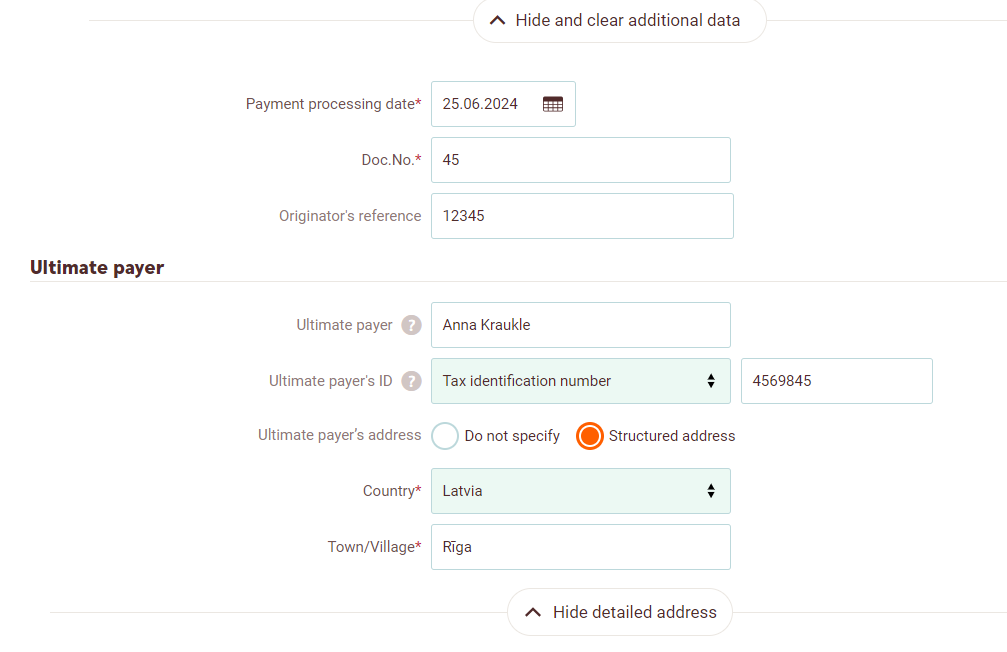

8. Payment IDs

-

End-to-End ID (Originator Reference)

- Passed to the receiver

- Mandatory in SEPA and Instant

pacs.008messages - If not provided by customer → field is filled with

"NOTPROVIDED"

-

Instruction ID (Document Number)

- Internal ID used by the sender

- Optional in SEPA and Instant payments

-

Transaction ID

- Generated automatically by the system

- Main ID used in the payment flow

- Not entered by the customer

9. Private / Corporate Identifier

Identifies the receiver (optional for sender, auto-filled).

- Private: Often personal code, but may also be driver’s license, birth date/place, etc.

- Corporate: Usually the company’s legal ID (sometimes other formats are supported).

10. Ultimate Sender / Ultimate Receiver fields

The final (ultimate) party that the payment is sent from/receiver to - these are optional fields that are not used very often but they are still important to test.

Ultimate sender/receiver name - follows the same rules as the regular sender/receiver name.

Ultimate sender/receiver identifier - follows the same rules as the regular sender/receiver identifier.

Here is an example of a payment form from SWEDBANK LV with the mandatory fields filled

For Internal/SEPA and Instant payments usually these fields are enough

And here are the optional fields of the UI form