Payment Types

A payment type is the way money is transferred between the sender (debtor) and the receiver (creditor).

For regular private users, the most common payment types are: Internal, SEPA, and Instant.

SWIFT and TARGET2 payments usually have higher fees and are used in specific cases or by companies.

Sometimes banks provide different sections in the Internet Bank UI for each payment type. Other times, the type is automatically detected based on customer-entered details.

Overview of Payment Types

- Internal payments – payments within the same bank.

- SEPA payments – EUR payments within the EU and a few other countries. Processed only on working days and can take a few hours to a few days.

- Instant payments – EUR payments in the EU and a few other countries. Executed 24/7, with delivery in 5–30 seconds.

- SWIFT payments – international worldwide payments supporting all currencies.

- TARGET2 payments – urgent EUR payments managed by the Eurosystem, available also outside the Eurozone.

Internal Payments

Definition: Payments within the same bank.

Examples:

- Transfer between your own accounts

- Payment to a friend in the same bank

- Payment to a company using the same bank

Processing speed:

- Very fast (often under 1 minute) since few or no external systems are involved.

Fees:

- Usually free or very low (e.g., under €0.15).

Currencies:

- Mostly local currency (e.g., EUR in Latvia).

- Currency exchange is possible between different currency accounts (e.g., EUR → USD).

External system use:

- Minimal or none (fully internal to the bank).

Testing suggestions:

- Check customer statements

- Verify current balance

- Verify payment record status in bank system

- Confirm that sender details appear correctly for the receiver

SEPA Payments

Definition: EUR payments within the Single Euro Payments Area (EU + a few additional countries).

Example:

- Sending EUR to a person in another European bank.

Processing speed:

- Processed only on workdays in cycles.

- Example cycle times: 10:00, 12:00, 13:00, 15:00, 17:00.

- Payments sent after the last cycle (e.g., Friday 17:00) will arrive on the next business day.

Fees:

- More than internal payments but much less than SWIFT.

- Example: €0.36.

Currencies:

- EUR only.

- Some banks allow automatic currency conversion from/to non-EUR accounts.

Countries:

- 36 SEPA-participant countries (EU + non-EU).

- List of SEPA countries (EPC website).

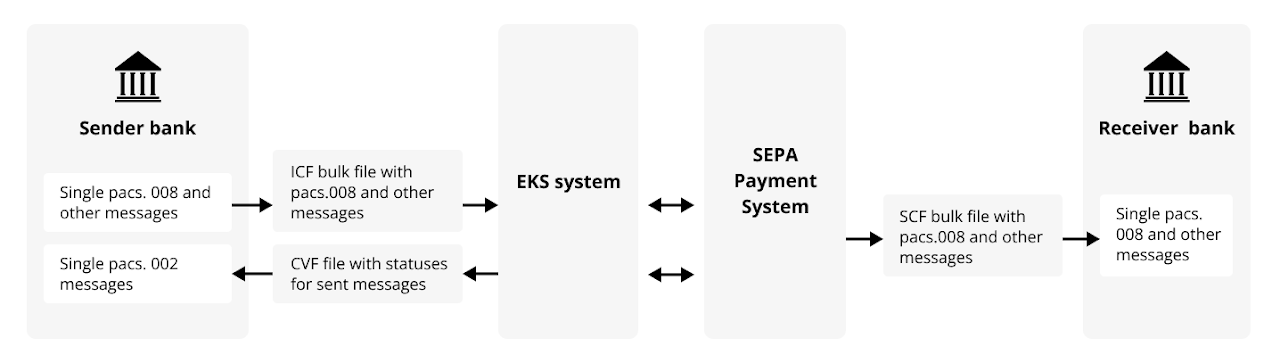

External system use:

- SEPA system directly (e.g., STEP2), or via a correspondent system (e.g., EKS – Latvijas Banka).

- For Instant payment message examples including XSD schemas see the Latvijas Banka EKS description.

Example flow:

- Payments are exchanged in bulk files (up to 10,000+ messages).

- Outgoing: ICF file → EKS.

- Incoming: SCF file → bank.

- Status: CVF file with pacs.002 confirmations.

Flow example with Latvia Central Bank as a correspondent bank (EKS system)

Testing suggestions:

- Same as Internal + message-level validation.

- Check that outgoing messages contain all user-entered data.

- Validate XML messages against XSD.

- Confirm acceptance by SEPA system.

Instant Payments

Definition: EUR payments in SEPA countries, delivered instantly (5–30 seconds), 24/7.

Example:

- Same as SEPA, but faster.

Processing speed:

- Near-instant (under 10 seconds).

Fees:

- Similar to SEPA (e.g., €0.36).

Currencies:

- EUR only, with possible conversion if banks allow.

Countries:

- Same as SEPA.

- List of SEPA countries.

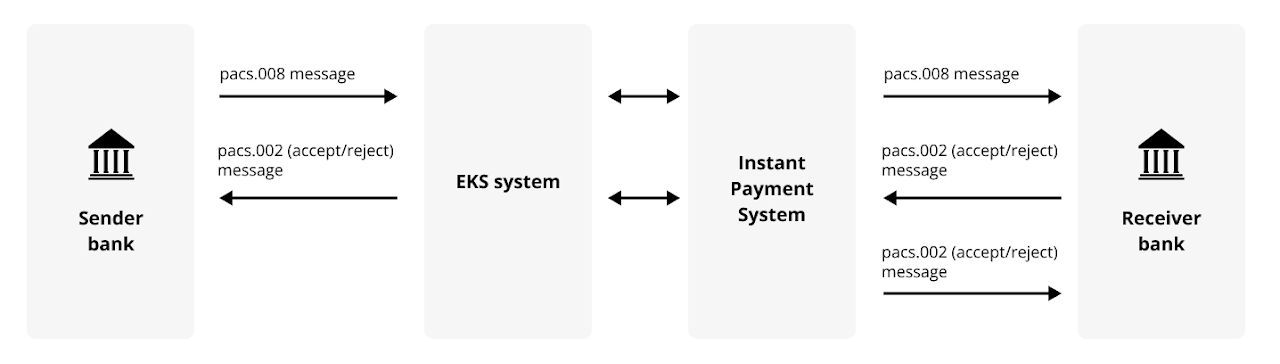

External system use:

- Similar to SEPA, but messages are sent individually (not bulk).

- Example: Latvijas Banka Instant EKS description.

Example flow:

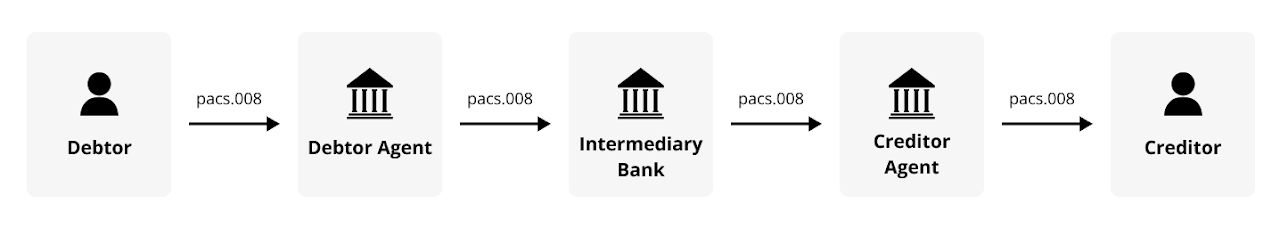

- Sender bank → pacs.008 → Instant system → receiver bank.

- Receiver responds with pacs.002 (accept/reject).

- Confirmation sent to both sides in real-time.

Testing suggestions:

- Performance under real-time load.

- 24/7 operation reliability (incl. during maintenance).

- Edge cases (midnight, month-end, leap year).

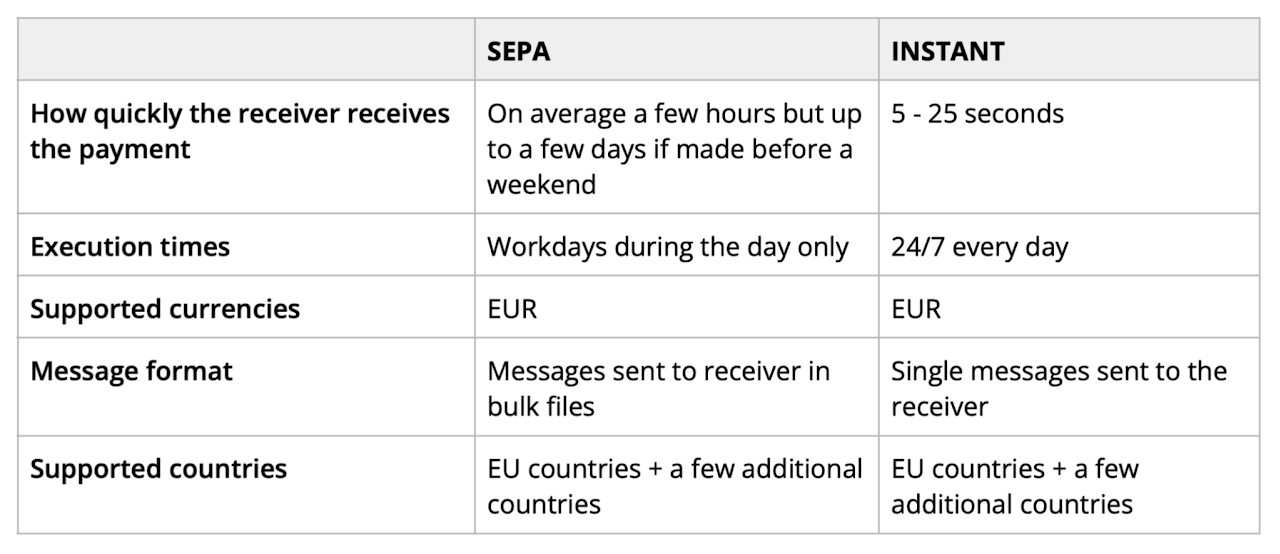

Comparison of SEPA and Instant payments

The SEPA and Instant payment systems have many similarities - this section will highlight the main differences between them.

TARGET2 Payments

Definition: Urgent EUR real-time gross settlement (RTGS) system operated by Eurosystem.

Examples:

- Large-value or urgent EUR transfers, often used by central banks and businesses.

Processing speed:

- Real-time. Funds available immediately.

Fees:

- Higher than SEPA, lower than SWIFT.

- Example: €10+.

Currencies:

- EUR only (currency conversion may apply before sending).

Countries:

- Mandatory for Eurozone banks.

- Also available to non-Eurozone banks (e.g., Bulgaria, Denmark, Poland).

External system use:

- Payments sent via ESMIG gateway.

Example flow:

- Payment → pacs.008 message.

- Rejected messages → pacs.002 with error details.

Testing suggestions:

- Validate pacs.008 XML content (debtor, creditor, amount, references).

- Ensure XSD validation.

- Confirm booking in account statements (camt.052, camt.053).

SWIFT Payments

Definition: Global cross-border payment network using bank codes (BIC/SWIFT codes).

Examples:

- International payments where banks use Nostro/Vostro accounts.

- If no direct relationship, intermediary banks are involved.

Processing speed:

- 1–3 days (depends on banks, intermediaries, holidays).

Fees:

- Varies, depends on:

- Bank’s pricing

- Urgency

- Intermediary banks (each may charge fees)

Currencies:

- All currencies (depends on correspondent banking agreements).

Countries:

- Global, to any bank in the SWIFT network.

External system use:

- Transitioning from MT103/MT202 to ISO 20022 pacs.008 format.

Example flow:

- Bank generates pacs.008 message → SWIFT.

- SWIFT replies with:

- ACK (acknowledge)

- NACK (non-acknowledge)

Testing suggestions:

- Validate urgency and charge types.

- Verify Nostro/Vostro accounts used.

- Test with both minimal and full optional data.

- Ensure correct fee booking.